How Does Workers' Compensation Protect My Business?

While workers’ compensation laws vary by state, generally speaking, most employers must purchase workers’ compensation

coverage

for their employees. Requirements typically depend on the nature of your business, the size of your business and the type of work your employees are doing. Keep in mind, every state has its own definition of a covered employee. To verify who is subject to workers’ compensation in your state, you can visit findlaw for your state’s requirements.

Workers compensation insurance is often mandatory for many businesses if they have employees, no matter what the job requires. It cover s medical costs and a portion of lost wages for employees who become injured or ill on the job. Workers compensation is like an airbag for your business. When trouble strikes, it deploys to help your employee get back to work as fast as possible, minimizing the damage to your business. If that sounds like a luxury to you, keep in mind, it's probably a good thing for your business. Imagine having to pay for a slip-and-fall accident out of your business checking account.

Employee accidents, injuries, and illnesses can happen at work. When they do, workers compensation insurance could protect your business and employees by covering things like medical bills, lost wages, and more.

Workers’ compensation insurance is a specific type of business insurance that helps business owners provide wages and medical benefits to employees who have been injured on the job. In most states, workers’ compensation is required by law. The origins of workers’ compensation benefits date back to the 18th century when pirates ruled the oceans. Privateering (the gentleman’s term for piracy) was a dangerous occupation; taking booty (treasure) away from those who did not want to give it up led to sea battles, hand-to-hand combat and often injury. Because of the inherent chance of impairment, a system was developed to compensate injured “employees.

Who is Required to Carry Workers’ Compensation Insurance?

If employees get hurt on the job, employers can direct them to their insurance company's worker's compensation system for quality medical and prompt payment of benefits and an early return to work. Wisconsin employers that meet specific requirements are required to carry worker's compensation insurance unless they qualify for self-insured status.

Employers receive the assurance they will not be sued for damages, medical care and lost wages if their employees get injured while working. You must have worker's compensation if any of your businesses:

usually employ three or more full-time or part-time employees. You must get insurance immediately. Employ one or more full-time or part-time employees to whom you have paid combined gross wages of $500 or more in any calendar quarter for work done at one or more locations in wisconsin.

Workers' compensation insurance (wci) provides employees with medical benefits and, in some cases, weekly income payments, if you suffer a work related injury or occupational illness. For an injury or illness to be work related, it has to originate while you are engaged in the work your job requires you to do for the university. You're entitled to medical aid, hospital services, and medication required at the time of injury, and afterwards, to treat the work related injury. In some cases, you may get financial benefits to make up for a portion of lost earnings and/or a permanent impairment from the injury.

Today's workers compensation and employers liability insurance policy was developed by the national council on compensation insurance ( ncci ) and covers the insured's statutory liability under the various state workers compensation laws or acts. Workers' compensation, also known as workers comp is insurance coverage required by state laws. It is designed to provide compensation for workers who are injured on the job in the course of their employment. Work comp insurance is always paid for by the employer. Workers compensation is based on a system by which no-fault statutory benefits prescribed in state law are provided by an employer to an employee (or the.

Under arizona law, it is mandatory for employers to secure workers’ compensation insurance for their employees, regardless of the number, whether those workers are part-time, full-time, minors, immigrants, friends, or family members. When applying for an arizona contractor’s license, a company must either provide a policy number or attest to having no employees and meeting one of the exemptions outlined by the industrial commission of arizona. Failure to comply with arizona law regarding workers' compensation is grounds for citations, suspension, or revocation of a license. 1099 independent contractors although workers' compensation is generally not required under arizona law for independent contractors, this does not apply to licensed contractors.

So What Do Workers’ Compensation Insurance Laws Look Like for Different States?

If an employee is injured by accident or occupational disease arising out of and in the course of their employment, they may be entitled to workers’ compensation benefits. Workers’ compensation insurance covers the risk of an employee getting injured on the job. Workers’ compensation is different and separate from unemployment compensation, social security disability benefits, health and accident insurance, or other disability benefit plans provided by the employer. The nebraska workers’ compensation act (the act) is found at section (§) 48-101 to § 48-1,118 of the nebraska revised statutes (laws, written as “neb. Rev. Stat. ”). It provides the only avenue for employees to obtain benefits from their employer for their work-related injuries.

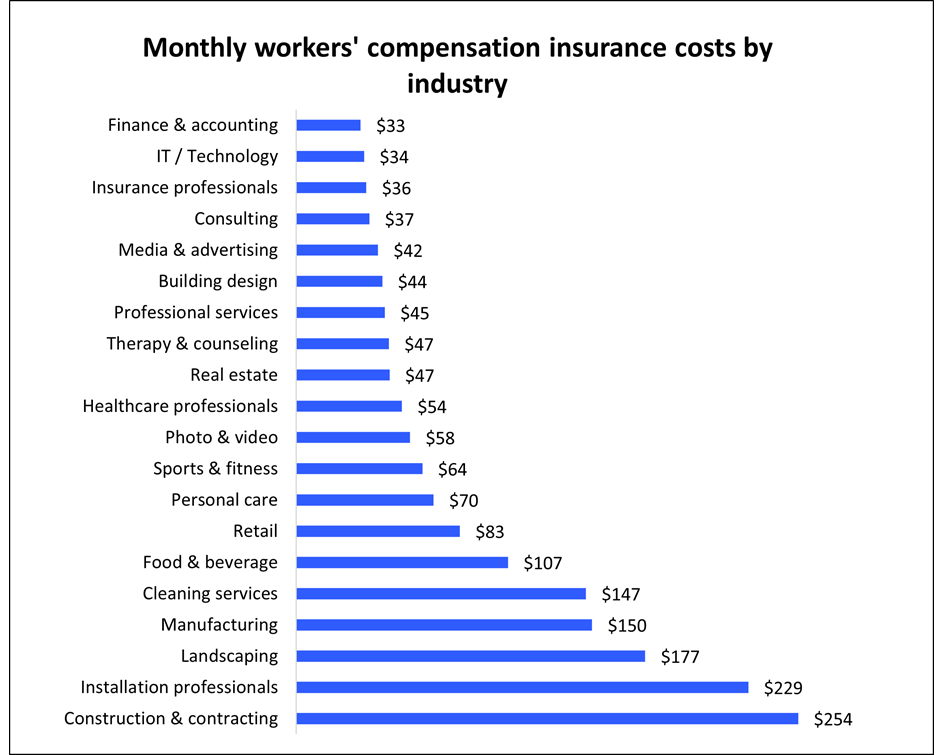

The average cost of workers’ compensation insurance per $100 in wages ranges from $. 75 in texas to $2. 74 in alaska. Workers’ comp insurance premiums are calculated based on the gross annual payroll you pay to employees. The more payroll expenses you have, the higher your workers’ comp insurance premiums. Workers’ comp insurance premiums are also influenced by your claims history, the requirements of your employees’ roles, the type of business you’re in, and state laws.

Workers’ compensation insurance was implemented to compensate employees for medical expenses or lost wages as a result of work-related injuries or illnesses. It is governed by state laws. Each state has its own workers’ compensation insurance commission that oversees the operation of the state plan. If you have employees and you do not have the coverage you run the risk of having to defend yourself from a lawsuit if an employee is injured on the job. This obviously can become a disaster if these costs are being paid directly out of your pocket. Furthermore, if they are successful with their lawsuit you will be responsible for paying any judgment as well.

Will Workers' Comp Cover Me If An Employee Sues Me for Getting Hurt on the Job?

Other than texas, every state mandates that companies carry workers’ compensation insurance either through a private insurer or the state, or the business can elect to be self-insured. Each state has different rules regarding what is covered, how issues are evaluated, how medical care is delivered and the benefits an employee can receive, so it’s important to check your state’s regulations. Failure to carry the required insurance can result in you paying for the benefits out of pocket, as well as penalties levied by the state. The cost for workers’ compensation insurance varies by provider and industry (high-risk jobs like roofing and construction carry higher premiums than office jobs, for instance).

What Is Workers' Compensation Insurance?

When you pay someone to provide support to you or your family member within your home or in the community, they are considered to be a domestic employee and must be paid in accordance with the us department of labor's fair labor standards act related to domestic service employees. If the person works for you for 26 hours or more during a week, you are legally required to have a workers' compensation policy. Workers' compensation insurance can typically be purchased through your insurance agent the same way you purchase auto or home insurance and will typically cost around $700 a year.

Workers compensation insurance provides support for workers with a work-related injury. Most employers in nsw are legally required to have a workers compensation policy to protect them from the costs of workers compensation claims (unless they are exempt ). Workers compensation assists with the costs of weekly benefits, medical and hospital expenses and a range of other benefits to help the worker recover and return to work. Workers compensation insurance can also provide: domestic assistance education or training assistance payments property damage claims lump sum compensation for permanent impairment work break and journey claims hearing impairment claims exempt worker claims (by police officers, firefighters and paramedics) payments in the event of death.

Insurance bulletin 22-07 was issued to provide updated and continued guidance from the west virginia offices of the insurance commissioner (“oic”) relating to the content of written decisions issued in west virginia workers’ compensation claims. This guidance is intended for all insurance carriers, third-party claims administrators and self-insured employers. This guidance has been, at least in part, issued previously. However, this insurance bulletin is being issued with an effective date of july 1, 2022, due to the workers’ compensation litigation changes that are beginning to take effect, including the new duties and adjudicatory responsibilities of the workers’ compensation board of review and the subsequent termination of the workers’ compensation office of judges.

Who is required to carry workers’ compensation insurance? employers with one or more full-time, part-time, seasonal, or occasional employees are required to maintain a workers’ compensation policy unless specifically exempt from the law. Workers’ compensation is required to be in place before the first employee is hired. Can i buy coverage for exempt employment? in some cases, you may elect coverage for exempt employment. Contact your insurance agent or representative for more information on electing coverage for exempt employment. What are the penalties if i don’t have workers’ compensation insurance? if one of your employees is injured and you do not have workers’ compensation insurance in effect at the time of the injury, you can be personally liable for all benefits, including medical and wage loss, provided under the workers’ compensation law.

Comments

Post a Comment