Personal Risk Management and Insurance

Insurance shopping simplified by technology, backed by generations of experience.

Coverhound® is an original insurtech that allows consumers and businesses to easily compare and purchase

insurance

online — offering competitive rates and coverages in all 50 states with fast, accurate and actionable quotes from a-rated u. S. Insurance carriers. Coverhound is part of the retail segment of brown & brown, inc. (nyse: bro), a leading insurance brokerage firm, delivering risk management solutions to individuals and businesses since 1939. The brown & brown team is as connected locally as it is nationally, with more than 8,000+ retail teammates in 300+ locations across the u.

Coverhound® is an original insurtech that allows consumers and businesses to easily compare and purchase

insurance

online — offering competitive rates and coverages in all 50 states with fast, accurate and actionable quotes from a-rated u. S. Insurance carriers. Coverhound is part of the retail segment of brown & brown, inc. (nyse: bro), a leading insurance brokerage firm, delivering risk management solutions to individuals and businesses since 1939. The brown & brown team is as connected locally as it is nationally, with more than 8,000+ retail teammates in 300+ locations across the u.

Insurance Coverage Analysis Package

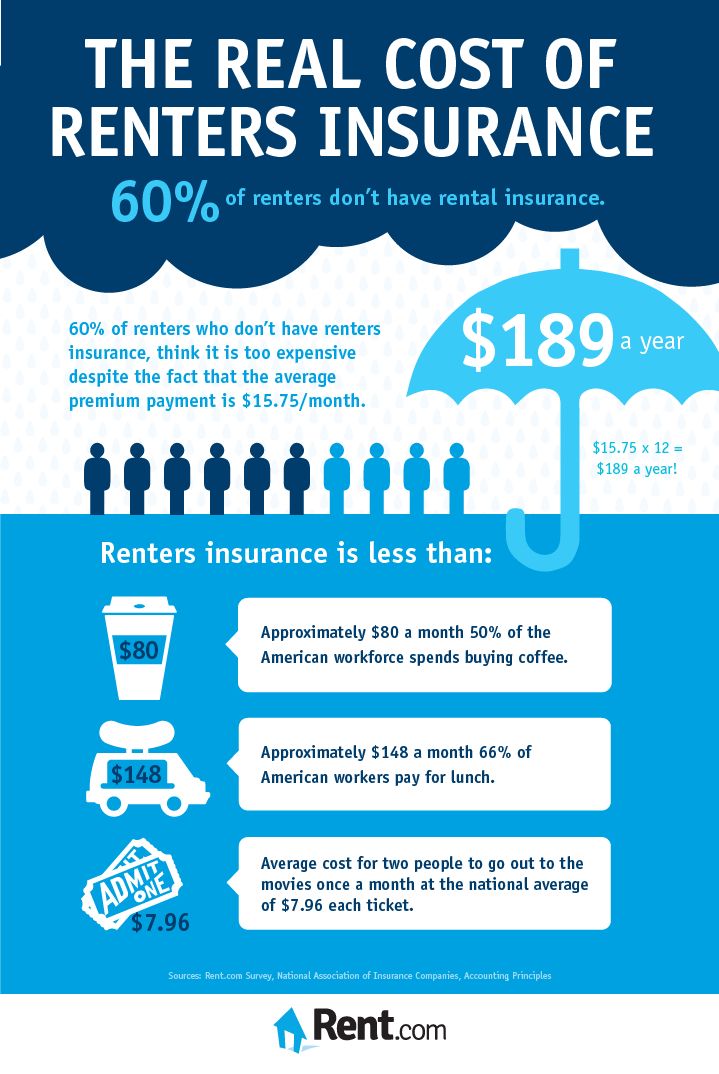

There are a number of optional coverage s available that do not form part of the standard tenants package but should be given some serious consideration when buying insurance. Sewer backup coverage, for instance, is designed to help protect you and your belongings in the event of damage as a direct result of your sewer backing-up. Earthquake coverage, on the other hand, provides coverage for a loss or damage caused by an earthquake. You can select your own deductible (calculated as a percentage of the limit placed on your personal belongings)

and you’re all set.Coverage for personal liability

You took great care in selecting the right place to live. You’ve moved in your personal belongings and added your personal touches to make your apartment or rental house a home. It makes sense that you would take the same great care to financially protect yourself and your contents. Take a quick inventory of your furniture, electronics, clothing, small appliances, and televisions and ask yourself if you could afford to replace those items in the event of a loss. The renters policy provides coverage for perils such as: fire vandalism

protect your home and enjoy peace of mind with allianz home insurance. Now 10% off new policies online!.

Comments

Post a Comment