What types of life insurance are there?

Here are types of life

insurance

.

Life insurance is an important financial safety net that provides an income tax-free death benefit to beneficiaries upon your death. 1 use our detailed life insurance calculator to help determine your needs. Beneficiaries can use the money to help with their everyday living expenses – such as mortgage payments or medical bills, education expenses, your funeral costs and more. Securian financial offers two main types of life insurance policies: term and permanent. We’ve created a side-by-side comparison to help you understand the main features of each type and how they compare.

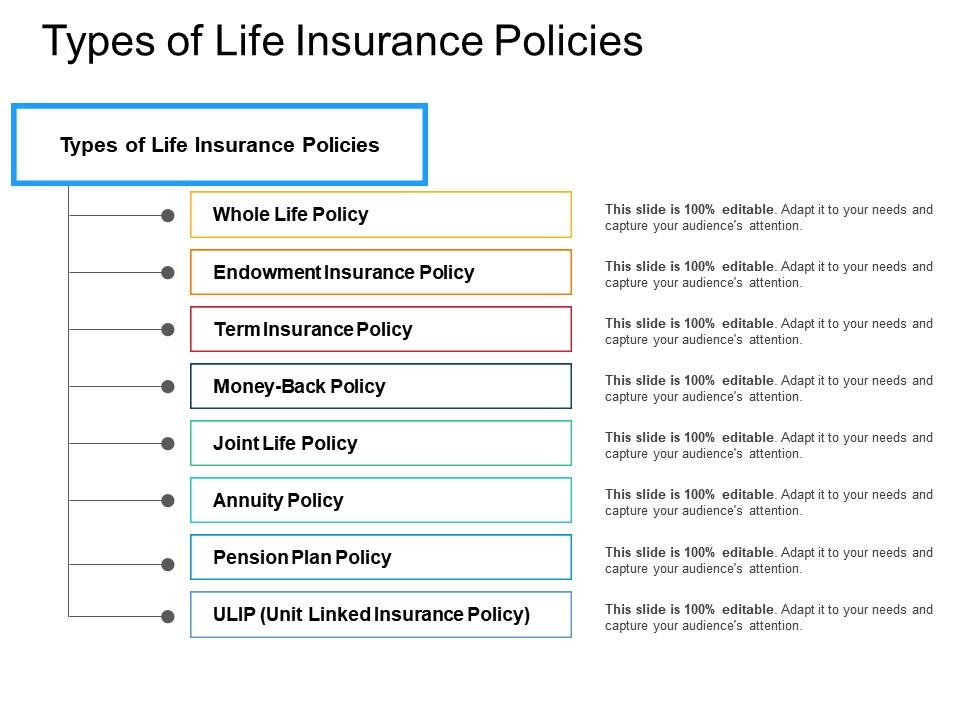

In life, unplanned expenses are a bitter truth. Even when you think that you are financially secure, a sudden or unforeseen expenditure can significantly hamper this security. Depending on the extent of the emergency, such instances may also leave you debt-ridden. While you cannot plan ahead for contingencies arising from such incidents, insurance policies offer a semblance of support to minimise financial liability from unforeseen occurrences. There is a wide range of insurance policies, each aimed at safeguarding certain aspects of your health or assets. Broadly, there are 8 types of insurance, namely:.

Schwab offers two types of life insurance, term and permanent, to provide your family with financial resources in the event that you can no longer do so. Schwab's insurance program provides guidance in choosing the right type of insurance coverage and offers price quotes from a choice of providers. Compare term and permanent life.

Types of Life Insurance

1 january 2021 (updated annually)

having adequate life insurance cover provides you and your family with financial protection in the event of unexpected death, illness, injury or a major health catastrophe (such as disablement, a heart attack or cancer).

Insurance coverage provides you with peace of mind. It aims to remove or reduce the financial stress that inevitably occurs as a result of these events. The main types of insurance cover are as follows:.

The primary purpose of life insurance is to provide for dependents should the family provider die. However, there are differences in types of insurance that allow different benefits and risks. Some types of life insurance are for a specific “term” or period of time. Some types of life insurance include the accumulation of cash value in exchange for a higher premium. The next sections describe the differences between basic types of life insurance, as well as how to determine who should be insured. The three main categories of life insurance are term life, whole life, and universal life, although there are options within each category:.

Is a type of insurance where the premiums charged are higher at the beginning than they would be for the same amount of term insurance. The part of the premium that is not used for the cost of the insurance is invested by the company and builds up a cash value that may be used in a variety of ways. You may borrow against a policy’s cash value by taking a policy loan. If you don’t pay back the loan and the interest on it, the amount you owe will be subtracted from the benefits when you die, or from the cash value if you stop paying premiums and take out the remaining cash value.

Common types of life insurance policies

Life insurance (or life assurance, especially in the commonwealth of nations ) is a contract between an insurance policy holder and an insurer or assurer , where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person (often the policy holder). Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. The policy holder typically pays a premium, either regularly or as one lump sum. The benefits may include other expenses, such as funeral expenses. Life policies are legal contracts and the terms of each contract describe the limitations of the insured events.

Guaranteed universal life insurance

Download riversource life insurance prospectuses or request a complimentary initial consultation with a financial advisor. Before you purchase, be sure to ask your financial advisor about the life insurance policy’s features, benefits, risks and fees, and whether the life insurance is appropriate for you, based upon your financial situation and objectives. Policies and features may not be available in all states, or may vary by state. 1 each person represented is a policyholder or beneficiary of an insurance policy issued by riversource life insurance company or riversource life insurance co. Of new york, and is discussing his/her experience in that regard.

Lifetime protection that also builds cash value. If you're looking for a policy that's guaranteed to grow and is designed to offer permanent lifetime protection this is it. Your policy also provides cash value, which is money that accumulates in your policy over time. Eligible policy owners may also receive an annual dividend, which can help grow the cash value even faster. (dividends are not guaranteed, but new york life has paid dividends to eligible policy owners every year since 1854. )whole life is also something to consider if you'd like the flexibility to supplement your retirement income by accessing the cash value of your life insurance policy. *.

Fully underwritten life insurance

Term to 100 policies provide life insurance coverage through to the age of 100 but usually do not have cash values. Their premiums are usually lower than whole life policies. Term life insurance for couples couples need to consider what coverage they may already have through group policies provided by their employers, as well as coverage they may have purchased while single. Make sure you weigh the options carefully, considering all the pros and cons. If you get married and both parties have life insurance policies, contact your insurance agent or company to find out what options you may have.

Individual policies: coverage underwritten by american family life assurance company of columbus. In new york, coverage underwritten by american family life assurance company of new york. Direct to consumer individual coverage underwritten by tier one insurance company. Aflac worldwide headquarters | columbus, ga aflac group policies: continental american insurance company (caic), a proud member of the aflac family of insurers, is a wholly-owned subsidiary of aflac incorporated and underwrites group coverage. Caic is not licensed to solicit business in new york, guam, puerto rico, or the virgin islands. For groups sitused in california, group coverage is underwritten by continental american life insurance company.

Comments

Post a Comment