What Doesn't Workers' Compensation Insurance Cover?

When a claim is denied, it means your employer's worker's compensation

insurance

adjuster believes your injury is not compensable, meaning that your injury was not caused by the work that you perform and it is not covered by workers' compensation. If the adjuster denies your claim, you have a right to challenge the decision. If a dispute regarding compensability occurs, you may seek help resolving the dispute from the bureau. Call an ombudsman at (800) 332-2667.

Workers compensation and employers liability is a form of no-fault insurance provided by the employer for the employee. The employee gives up certain rights to sue in exchange for protection from injuries incurred on the job. Insurance rates are developed by taking all losses from similar employers and aggregating them. There are approximately 600 classifications of employers in north carolina and the classification your company falls under will effect the rates your business is eligible for. Rates can and do vary from one insurance company to another. Insurance companies would look at such issues as employee selection and training, first aid, medical evaluation, safety promotion, housekeeping and maintenance, material handling and protective clothing and equipment.

Employees are the lifeline of any business, and no matter what industry, they can be a company's most important asset. But when slips, falls, back strains and other such incidents occur during the course of employment, it can mean valuable time away from serving customers and keeping the business running profitably. At cna, our workers' compensation insurance offers cover age for medical expenses and wage replacement for employees injured in the course of employment. We also have information and training to help ensure that workplaces are safe, and our risk control professionals have expertise in building health and safety programs for companies of all sizes.

Insurance bulletin 22-07 was issued to provide updated and continued guidance from the west virginia offices of the insurance commissioner (“oic”) relating to the content of written decisions issued in west virginia workers ’ compensation claims. This guidance is intended for all insurance carriers, third-party claims administrators and self-insured employers. This guidance has been, at least in part, issued previously. However, this insurance bulletin is being issued with an effective date of july 1, 2022, due to the workers’ compensation litigation changes that are beginning to take effect, including the new duties and adjudicatory responsibilities of the workers’ compensation board of review and the subsequent termination of the workers’ compensation office of judges.

How Does Workers' Compensation Protect My Business?

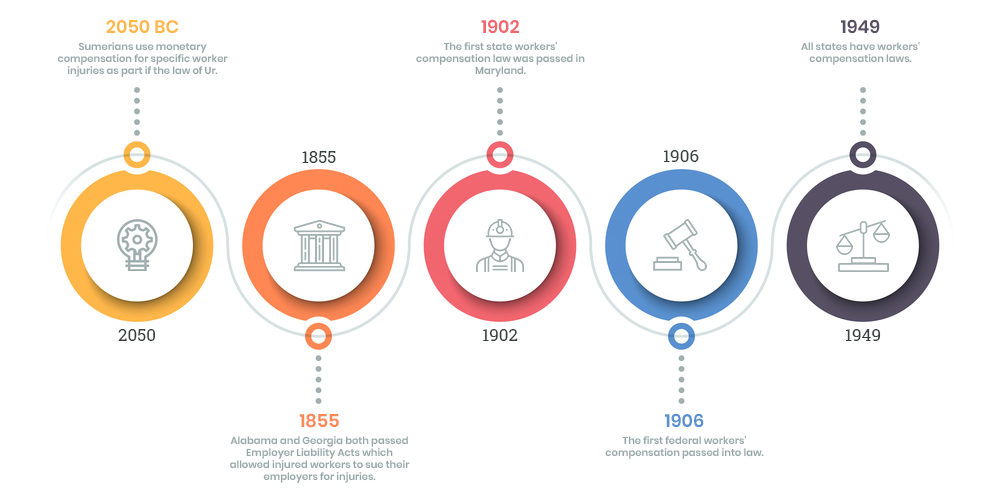

Workers’ compensation insurance is a specific type of business insurance that helps business owners provide wages and medical benefits to employees who have been injured on the job. In most states, workers’ compensation is required by law. The origins of workers’ compensation benefits date back to the 18th century when pirates ruled the oceans. Privateering (the gentleman’s term for piracy) was a dangerous occupation; taking booty (treasure) away from those who did not want to give it up led to sea battles, hand-to-hand combat and often injury.

![]() Because of the inherent chance of impairment, a system was developed to compensate injured “employees.

Because of the inherent chance of impairment, a system was developed to compensate injured “employees.

The average cost of workers’ compensation insurance per $100 in wages ranges from $. 75 in texas to $2. 74 in alaska. Workers’ comp insurance premiums are calculated based on the gross annual payroll you pay to employees. The more payroll expenses you have, the higher your workers’ comp insurance premiums. Workers’ comp insurance premiums are also influenced by your claims history, the requirements of your employees’ roles, the type of business you’re in, and state laws.

Workers’ compensation is a type of insurance that protects businesses and their employees from the cost of workplace injuries. Many small businesses rarely see injuries, but they may actually be the least prepared to navigate the system and control business costs when an accident does occur. Workers’ comp is designed to cover medical bills and lost wages when someone is injured at work. Benefits can also include payments to compensate for permanent disabilities and to dependents of workers who are killed in job-related incidents. A workers’ comp policy also covers the employer in case an injured employee brings a lawsuit for alleged negligence.

Employers’ are required to post notice that they are in compliance with workers’ compensation laws. These notices, which must be placed in conspicuous locations at the place of business, are available free of charge in english and spanish at the labor commission and on the labor commission’s website on the industrial accidents resources page.

Who is Required to Carry Workers’ Compensation Insurance?

Workers' compensation insurance is a type of insurance specifically designed to provide medical benefits and, in some cases, financial payments to employees on the payroll of the university of texas rio grande valley (utrgv) who suffer injuries or occupational diseases in the course and scope of employment. In instances of injury or illness arising out of or in the course of employment, the employee is entitled to all medical aid, hospital services, and medication reasonably required at the time of injury and anytime thereafter to cure and relieve the effects naturally resulting from the injury. In some instances, financial benefits will be available to offset a temporary loss of wage earning capacity and/or to compensate for permanent impairment due to the injury.

Workers’ compensation is a state-mandated benefit for employees with work-related injuries and illnesses. Employers are required to provide benefits in cases of injury, illness, exposure, death, or aggravation of a pre-existing condition resulting from employment. Stanford provides no-fault workers’ compensation insurance. Employees who are unable to work because of a work-related injury or illness may be entitled to partial income replacement in the form of disability benefits and medical treatment based on the nature of the injury. For stanford university, these benefits presently are administered by zurich north america. The office of risk management collaborates with zurich on claims management.

Workers’ compensation for a nanny provides medical and wage benefits for their employees who are hurt or become ill on the job. It can cover a worker’s medical bills and a portion of their lost wages. It also protects you, as the employer, from liability. Workers’ compensation coverage is typically required in most industries. However, workers’ comp requirements for a nanny vary by state and may depend on the number of hours your employee works and how many workers you employ. Workers’ compensation insurance is different from disability insurance. In five states (california, hawaii, new jersey, new york, and rhode island), household employers are required to make payroll deductions for disability insurance.

Workers compensation insurance provides support for workers with a work-related injury. Most employers in nsw are legally required to have a workers compensation policy to protect them from the costs of workers compensation claims (unless they are exempt ). Workers compensation assists with the costs of weekly benefits, medical and hospital expenses and a range of other benefits to help the worker recover and return to work. Workers compensation insurance can also provide: domestic assistance education or training assistance payments property damage claims lump sum compensation for permanent impairment work break and journey claims hearing impairment claims exempt worker claims (by police officers, firefighters and paramedics) payments in the event of death.

What Does Workers’ Comp Cover?

If the state workers' compensation insurance denies payment, and if you give medicare proof that the claim was denied, then medicare will pay for medicare-covered items and services. In some cases, workers' compensation insurance may not pay your entire bill. Workers' compensation insurance may agree to pay only a part of your bill if both of these are true: you had an injury or illness before you started your job (called a " pre-existing condition ") the job made it worse this is because the job didn't cause the original problem. You and workers' compensation insurance may agree to share the cost of your bill.

If an employee is injured by accident or occupational disease arising out of and in the course of their employment, they may be entitled to workers’ compensation benefits. Workers’ compensation insurance covers the risk of an employee getting injured on the job. Workers’ compensation is different and separate from unemployment compensation, social security disability benefits, health and accident insurance, or other disability benefit plans provided by the employer. The nebraska workers’ compensation act (the act) is found at section (§) 48-101 to § 48-1,118 of the nebraska revised statutes (laws, written as “neb. Rev. Stat. ”). It provides the only avenue for employees to obtain benefits from their employer for their work-related injuries.

Who Is Covered by Workers’ Comp Coverage?

The employees’ safety and well being on the job are important to the employers. However, accidents and illnesses can arise from work and when they do, the employees are covered under the wc law. The hawaii wc law was enacted in 1915, and its purpose was to provide wage loss compensation and medical care to those employees who suffer a work-related injury. The wc law in essence requires the employer to provide certain benefits without regard to the fault of the employer and prohibits an employee from filing civil action against the employer for work-related injuries or illnesses. Any employer, other than those excluded (section 386-1), having one or more employees, full-time or part-time, permanent or temporary, is required to provide wc coverage for its employees.

Comments

Post a Comment